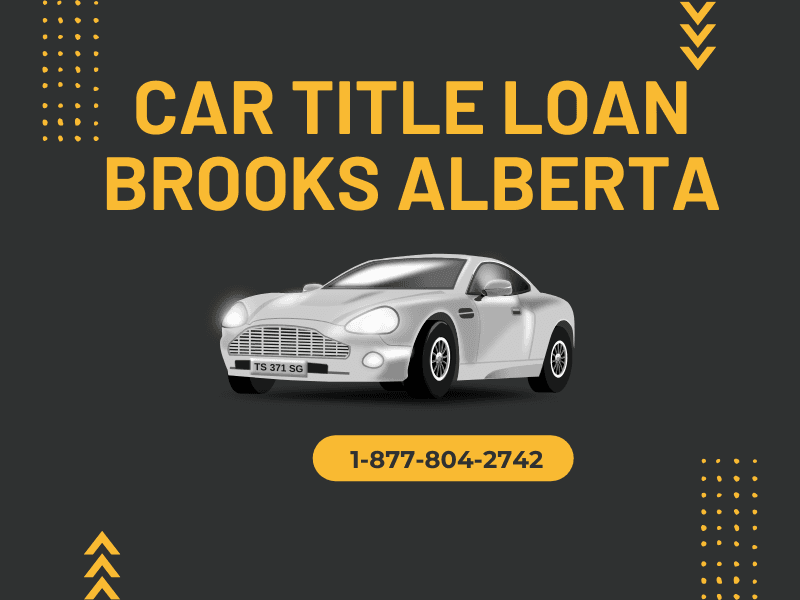

Welcome to Car Title Loans Canada – your go-to solution for quick and hassle-free financial help! Life can throw unexpected curveballs, and we get that. That's why we're here to offer a reliable and efficient way to get the money you need, using the value of your car. No need for a complicated application or perfect credit – our car title loans are flexible and convenient.

We make the loan process simple and prioritize your needs. Our dedicated team is all about providing personalized care to ensure you get the financial support you require with minimal stress. Whether it's emergency medical bills, home repairs, or any financial challenge, our title loans are designed to have your back during tough times. Getting the financial solutions you need is quick and easy with us – learn how convenient it is to secure a loan against your car's title.

Experience peace of mind by choosing Car Title Loans Canada as your financial partner. We're not just about loans; we value transparency and fairness throughout the lending process. Say goodbye to hoops and lengthy approvals – we understand the urgency of your financial needs and respect your time. Our goal is to give you an efficient borrowing experience tailored to your unique situation. Join the ranks of happy clients who trust us to navigate their financial challenges, and let us be your go-to option when life throws unexpected obstacles your way.

Call NowApply Now

How It Work

How Car Title Loans Work?

Our title loans allow you to use your vehicle as collateral for a quick and convenient loan. You can access cash without a lengthy approval process or perfect credit. Leverage the value of your car for cash.

Read More

Online Application

Fill out a brief online application by giving some basic details about your car and yourself.

Vehicle Assessment

To ascertain the maximum loan amount you are eligible for, our specialists evaluate the equity in your car.

Quick Approval

Our streamlined process allows for quick approval without requiring a perfect credit score.

Cash Access

Upon approval, you can keep driving your car while accessing the funds you need – a straightforward solution to address your short-term financial challenges.

Why are We The Best?

Choose car loans over conventional loans for a quicker, hassle-free process with no credit checks. Access funds using your car's value as collateral, and enjoy the flexibility of keeping and driving your vehicle during the loan term.

Quick Access to Cash

Our title loans are known for their quick cash approval process. If you need cash urgently and don't have time to go through the lengthy approval process of a conventional loan, a car title loan may provide a faster solution.

No Credit Check

Car title lenders typically do not require a credit check. For individuals with poor credit or a limited credit history, this can be an advantage compared to traditional loans, where a good credit score is often a prerequisite.

Flexibility in Eligibility

The eligibility criteria for car title loans may be more lenient compared to traditional loans. Lenders may be willing to work with borrowers who do not meet the stringent requirements of banks or credit unions.

No Employment Verification

Some car title lenders may not require proof of employment, making it an option for individuals who are unemployed or have irregular income. This is in contrast to conventional loans, which typically require proof of steady income.

Minimal Documentation Requirements

Car title loans often have simpler documentation requirements compared to conventional loans. The process may involve providing basic information about the vehicle and proof of ownership, making it less cumbersome for individuals who may not have extensive financial documentation readily available.

No Prepayment Penalties

Some car title loan agreements allow borrowers to repay the loan before the scheduled due date without incurring prepayment penalties. This can be advantageous for individuals who expect to have the means to repay the loan sooner and want to avoid additional costs.

5 Things That Sets Us Apart From Others

We at Car Title Loans Canada take great satisfaction in being an exceptional option for your financial requirements. Our dedication to quality is evident in five main areas that set us apart from the competition.

We stand out in the crowded financial landscape thanks to our commitment to openness and client satisfaction. Unlike traditional lenders, we put your convenience first and offer prompt, adaptable solutions to your particular financial problems. You won't need a perfect credit score to access funds quickly thanks to our streamlined application process. Additionally, you can confidently navigate your financial journey thanks to our commitment to fair lending practices and transparent terms. You can rely on our car loans to be your trustworthy partner, providing a private and secure procedure that puts your needs first and sets us apart in the world of financial solutions.

Quick Cash Disbursement

Receive the money you need in less than 24 hours, guaranteeing prompt access to financial assistance.

Transparent Fee Schedule

Have the peace of mind in knowing that there are no unstated costs. Our dedication to openness guarantees that you are receiving exactly what you pay for.

Competitive Interest Rates

Take advantage of the lowest rates available in the market, which not only make your car loan affordable but also easily accessible.

Flexible Repayment Terms

Gain flexibility and financial control by being able to pay off your loan early without incurring penalties.

Easy Application Process

We guarantee a hassle-free experience by providing you with the assistance you require without needless delays. Our online application process is quick and simple.

Requirement & Benefits

For financial purposes, applying online for car loans is a straightforward process with fewer requirements and lots of advantages.

Requirement For Loan Approval

The best options for car title loan are provided to our customers. Take a family vacation, settle your emergency debt, or obtain the money you require right now. If your car, truck, van, SUV, motorcycle, or recreational vehicle is less than 10 years old, you are eligible to apply.

The requirements for obtaining a car title loan today are listed below.

- Driver's License

- Lien/Loan free vehicle

- Proof of address

- Your vehicle's registration and insurance

- Spare keys to your vehicle

Advantages Of Using Your Car As Collateral For Title Loans

- The maximum loan repayment period is 48 months.

- In the industry, we offer the longest loan terms. For Up to 4 Years

- The most practical and adaptable methods of payment

- Low interest rates ranging from 8% to 29%

- We have the lowest monthly payments of $97/month!

Possible Title Loan Example:

Interest rates range from 8%. On a $5,000 loan with a 4-year term, monthly payments can start at $184.32

Find Out If You Are Eligible For Car Collateral Loans By Giving Us A Call TODAY.

Call Now: 1-877-804-2742Testimonials

Trusted for exceptional financial solutions, we pride ourselves on timely, transparent, and client-focused services, improving lives.

Recent Posts

Keep yourself informed and current with the newest financial solutions, insights and advice.

Start up an Event Catering with a Car Equity Loan Burnaby BC

Stephan M

Stephan M

April 16, 2025

April 16, 2025

Use a Car Title Loan Toronto Ontario for Car AC Repair

Stephan M

Stephan M

March 17, 2025

March 17, 2025

Use a Car Title Loan Calgary Alberta for Vehicle Inspection

Stephan M

Stephan M

February 14, 2025

February 14, 2025

Frequently Asked Questions

Getting around the world of car loans can raise some doubts and worries. We at Car Title Loans Canada value openness and make an effort to anticipate your questions. Discover the answers to some frequently asked questions so you can decide on our financial solutions with knowledge.

1. What is the maximum amount of money that Car Title Loans Canada can provide me with?

The assessed value of your car determines how much you can get with a Car Title Loan from Car Title Loans Canada. Our skilled team assesses a number of variables, such as your car's overall condition, make, model, and market value. We use this comprehensive evaluation to calculate the loan amount, and you can get up to the value of your vehicle.

2. After submitting an application for a car title loan, how soon can I receive the money?

We at Car Title Loans Canada are aware of how urgent financial situations can be. Following the expedited submission of your application and required documentation, the approval process begins. After signing the loan agreement, borrowers frequently receive approval the same day and receive the authorized loan amount within an hour.

3. Is it still possible for me to drive my car while I'm on loan?

It's possible! We understand how essential your personal vehicle is to your day-to-day activities. You are able to maintain and drive your vehicle for the duration of the loan with Car Title Loans Canada. We are committed to offering borrowers a user-centric approach that enables them to continue using and maintaining their cars while taking advantage of our financial solutions.

4. What are the terms of repayment for Canadian auto title loans?

We provide long-term repayment plans that are adjustable to meet your needs. Repaying the loan over four years for as little as $97 is a simple process. Our goal is to meet your needs and priorities while meeting your specific financial constraints with flexible solutions.

5. Do I need to have a high credit score to be granted a car title loan?

With Car Title Loans Canada, you can apply for a car title loan without having to have a perfect credit history. We are in favor of financial accessibility for everyone, and neither a job nor credit check is necessary during the approval process. The primary factor that determines the loan amount for your car is its assessed value.

1-877-804-2742

1-877-804-2742